does nevada tax your retirement

For many people who are considering a financially-based move from California to. The Silver State wont tax your pension.

10 Most Tax Friendly States For Retirees Kiplinger

Nevada does not tax retirees accounts or pensions.

. Since Nevada does not have a state income tax any income from a pension from a 401k from an IRA or from any other retirement account is not taxable. Retirement income may come. There is no specific military.

Up to 2000 of retirement income is exempt for taxpayers under age 60. A lack of tax. So the next question is how is retirement income taxed when you retire.

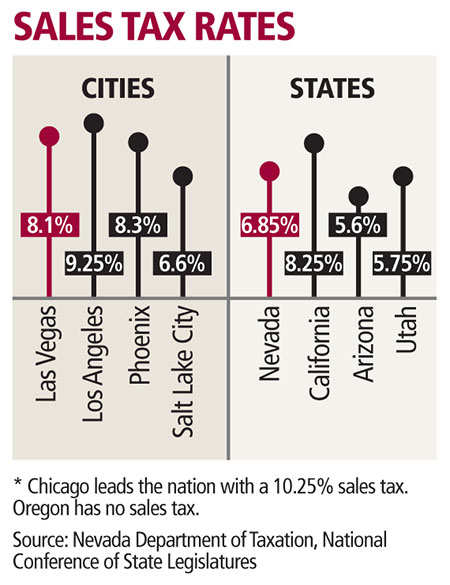

If your provisional income is less than 25000 for individual filers or 32000 for joint filers you wont have to pay taxes on your Social Security. Nevada sales tax is less than in California. Up to 12500 is exempt for taxpayers 60 and older.

800-742-7474 or Nebraska Tax Department. Retirees in Nevada are always winners when it comes to state income taxes. Nevada has no state income tax which means that all retirement income is tax-free at the state level.

This includes income from both Social Security and retirement. You do have to pay tax on retirement income. The short answer is yes.

Nevada is extremely tax-friendly for retirees. States That Dont Tax Retirement. Now that you have a good baseline knowledge of how retirement taxes work at the state level lets dive into the states that wont tax you at all.

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. How does nevada tax retirees. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the.

What states do not tax. It also has relatively low property taxes while the state sales tax is. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states.

However if your provisional. Does Nevada tax your retirement.

State Tax Information For Military Members And Retirees Military Com

10 Most Tax Friendly States For Retirees Nea Member Benefits

Why Your Taxes In Retirement Will Likely Be Lower Than You Expect

Fast Guide To Dual State Residency High Net Worth Investors

Taxes About To Increase Las Vegas Review Journal

14 States That Won T Tax Your Pension Kiplinger

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

14 States That Won T Tax Your Pension Kiplinger

States That Don T Tax Retirement Income Personal Capital

How Do State And Local Sales Taxes Work Tax Policy Center

Military Retirement And State Income Tax Military Com

Nevada Tax Rates And Benefits Living In Nevada Saves Money

15 States That Don T Tax Retirement Income Pensions Social Security

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

Arizona Vs Nevada Which State Is More Retirement Friendly

Retire In California Or Nevada Retirebetternow Com

Is Living In A State With No Income Tax Better Or Worse Bankrate